How to Save and Manage Money as a College Student

As a recent college graduate, I’ve learned countless ways to save and manage my money over the four years. For most, college is a great learning experience where students have very little income and lots of expenses all while having to build their financial foundation. There is no better time to practice good money habits than during this exciting and formative period in life.

According to research by Temple University and Wisconsin HOPE Lab, over 36% of college students are struggling with basic needs such as food and housing. These struggles come from a lack of financial planning and money management skills. Many are overpaying for their college expenses and are unprepared for unexpected expenses.

Here are my best tips of how I managed to stay on top of my bills, all while saving for spring break vacations and graduating college with an 800-credit score:

1. Get a personal checking account

The first step to build a strong financial foundation is to have a bank account of your own. Although sharing a bank account with your parents may seem like a convenient (quite frankly, it is awesome) thing to do, it’s time to leave yourcomfort zone and manage your ownfinances.

Empeople offers three types of checking accounts that will surely fit your needs. No minimum balance, no fees? You got it!

2. Track expenses with a mobile app or money app

Tracking expenses is the most crucial money habit that will pay off. Do you know how much you’ve spent on food a week? Do you have any subscriptions that you haven’t used? Maybe you hadone too many lattes last week. It’s important to track your cash flow in order to avoid spending on unnecessary things, as well as preventing overdraft charges. No one wants to be that person at the cash register when the cashier says you have insufficient fundson your account.

If you’re a member of Empeople, we have the great Money Manager tool that allows you to set a budget, manage your savingsgoals, and track your expenses.

3. Eliminate small recurring expenses

Now that you’ve tracked your payments regularly, it is time to review your costs and see where you could reduce your expenses. The key to living as a college student is to be as frustratingly frugal as possible. Any subscriptions or recurring fees that you’re paying for but rarely use should be canceled now!

4. Always pay your bills on time

Whether it’s a utility bill, rent, or a car loan, make sure you always make your payment on time. It directly affectsyour credit score, and you need those digits as high as possible for the best rates for any loans you want to take outin the future. It’s best to set up your bills on autopay so you’ll never miss a payment.

5. Set a weekly and monthly budget – and stick to it

I know it’s hard to stick to your budget sometimes. Maybe this month you have a flat tire or an extra parking ticket, but by knowing your weekly and monthly budget, you are better equipped to plan and adjust accordingly.

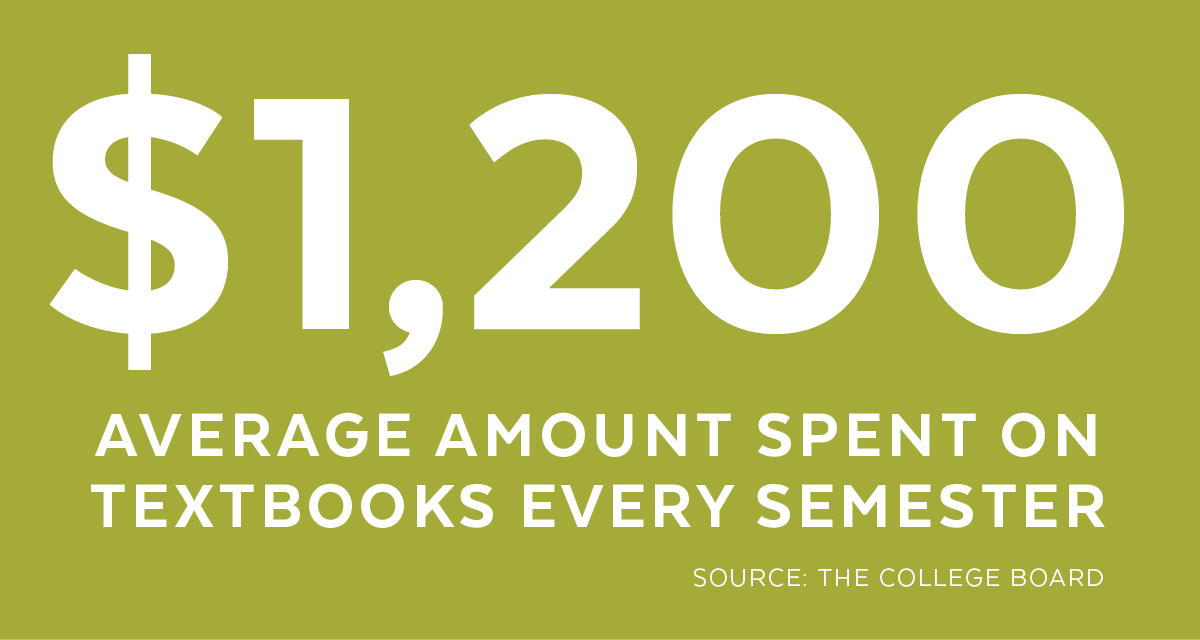

6. Buy used books or e-books

During my first year in college, I spent an excessive amount of money for new textbooks. If your class doesn’t require a new physical book, always go for used books. I used websites such as Abebooks, Chegg, Student Facebook Groups and sometimes even Amazon to find the best used-book deals. The key is to do your research and buy early.

7. Use social media groups to search for used furniture

Another great way to save — and sometimes even score free stuff — is through Facebook groups and Craigslist. Never buy new furniture, unless it is bedding. A ton of college students move in and out every year, and they tend to sell their new and/or slightly-used furniture for a fraction of the cost they paid for the item. If you’re lucky, you can even get items free if you are willing to haul it away for them. Happy hunting!

8. Do meal planning and cook at home

Skip the ongoing random McDonald’s or Chipotle runs, because those can add up quickly. Try to do meal planning and prepping once a week; not only is it more affordable, it is healthier as well.

9. Use a credit card

It’s hard to have good self-control, but getting a credit card as a student is a great way to build your credit score if you don’t have any outstanding loans. Remember, though, to always pay your bill when it is due.

10. Stay away from credit card debts

The rule of thumb is “don’t buy what you can’t afford.” Pay off your balance every month in full.

11. Take advantage of student discounts

One perk of being a student is that there are many student discounts, especially when it comes to traveling. My favorite is Student Universe for travel. Amazon Prime student accounts are also very beneficial.

12. Keep an eye out for free event lunches around and near campus

No further explanation needed for this. A free lunch is always a student’s best friend.

13. Leave your wheels at home

At least during the first year of college, staying in college is recommended for students to make friends and immerse themselves in the community. There is plenty of public and school transportation on campus, plus parking costs can add up. That said, if you choose to bring a car to campus for the next year, here is why it could be a good idea…

14. A car loan can help your credit score

Having a loan in your name and making consistent payments will improve your credit score and your creditworthiness. You may consider leasing vs. buying a new car. Do a quick search and browse hundreds of cars on your couch before you visit a dealership.

15. Read your rental agreement carefully and choose your roommate(s) wisely

When living with another person problems often arise, regardless if that person is your friend. The question becomes more serious when you share a rental apartment. Always read your rental agreement from top to bottom and through the fine print. If possible, choose to have a single renter contract where you’re not responsible for the other person’s rent if they’re late.

16. Set small savings goals

I know it may sound ridiculous to have saving goals while you have a tremendous amount of expenses in college. Start a small goal of building your emergency fund for the unexpected. Even if it’s just $10 a week, this habit will carry over for the rest of your life.

17. Taking cheaper general-education online classes at community colleges

I found myself saving a semester in college by taking lower-priced gen-ed classes online at a community college during academic breaks like summer and winter. If this option is available for you, take advantage of this!

18. Find paid summer and winter internships, as early as freshman year

What’s a better way to gain experience while getting paid at the same time? Experience sells better than your GPA. So, freshen up that resume, practice your handshakes, and get hired!

Going to college is an exciting journey where you’ll make many unforgettable memories. But don’t sweat it…it is a time for you to try, fail, and learn. Be ready to not only learn in the classroom but also educate yourself on personal finance through daily living. By understanding how to build a healthy FICO score, and by practicing good money management habits, you’ll be set for life.